Press Room

April 2024

The NKF Honors Dr. Martin Pollak with The David M. Hume Memorial Award for Pioneering Research in Kidney Genetics

(April 22, 2024, New York, NY) — The National Kidney Foundation (NKF) proudly announces that Nephrologist and Professor of Medicine Martin Pollak, MD, is the 2024 recipient of the prestigious...

April 2024

The NKF to Honor Nephrologist and NYU Professor of Medicine Dr. David Charytan with the Distinguished J. Michael Lazarus Award

(April 24, 2024, New York, NY) — The National Kidney Foundation (NKF) is thrilled to announce that Nephrologist and Professor of Medicine David M. Charytan, MD, MSc, will be...

April 2024

The NKF Urges Passage of New Home Dialysis Bill

Improving Access to Home Dialysis Act aims to reduce barriers to treatment and increase access to care

(April 22, 2024, Washington, DC) —The National Kidney Foundation (NKF) is...

April 2024

Dr. Robert A. Montgomery Receives the NKF’s Prestigious Excellence in Transplantation Award

(April 18, 2024, New York, NY) — The National Kidney Foundation (NKF) proudly announces that Robert A. Montgomery, MD, DPhil, FACS, is the 2024 recipient of the prestigious Excellence in...

April 2024

NKF Amplia el Acceso a Programas y Recursos Vitales Para Pacientes en Español

~ Fundación Mas Comprometida Que Nunca Con Mejorar La Equidad En La Salud Renal ~

(19 de abril de 2024, New York, NY) —La Fundación Nacional del Riñón (NKF) se enorgullece en anunciar un...

April 2024

The National Kidney Foundation Honors U.S. Health and Human Services Administrator Dr. Suma Nair with Esteemed Public Service Award

(April 15, 2024, New York, NY) — The National Kidney Foundation (NKF) is delighted to announce that Dr. Suma Nair is the recipient of this year's esteemed Public Service Award. Suma Nair, PhD...

April 2024

Washington State Renal Nutrition Expert Kathy Schiro Harvey Receives the NKF’s Prestigious Joel D. Kopple Award

(April 1, 2024, 2024, New York, NY) — The National Kidney Foundation (NKF) is excited to announce that Renal Nutrition Expert Kathy Schiro Harvey, MS, RDN, CSR, is the recipient of this year’...

March 2024

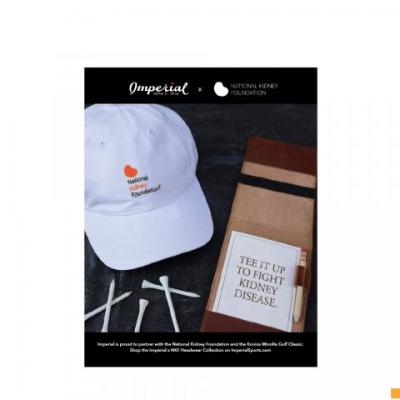

The National Kidney Foundation and Imperial Headwear Partner to Help People with Kidney Disease through the 37th Annual NKF Golf Classic

(March 20, 2024, New York, NY) —The National Kidney Foundation (NKF) is proud to announce that Imperial Headwear will join us once again as the “Official Headwear” of...

March 2024

The National Kidney Foundation’s 2024 Annual Kidney Walk Returns

~ National Walk Campaigns make every step count to help Families facing Kidney Disease ~

(March 22, 2024, New York, NY) —The National Kidney Foundation (NKF) is excited to launch NKF’s 2024...

March 2024

NKF Launches KidneyCARE™ Study To Empower Patients, Advance Kidney Disease Research

Groundbreaking interactive patient registry will help empower individuals with kidney disease to help pave the way for improved outcomes in kidney care

(March 20, 2024, New York, NY) — The...