Voices for Kidney Health advocates and National Kidney Foundation staff work together to pass legislation that would benefit the kidney community in state capitols across the country.

Minnesota-based advocate Jen Anderson shares why passing a Living Donor Protection Act in her home state was so meaningful to her.

After donating a kidney, Kentucky-based advocate Beth Burbridge knew she had to get more involved.

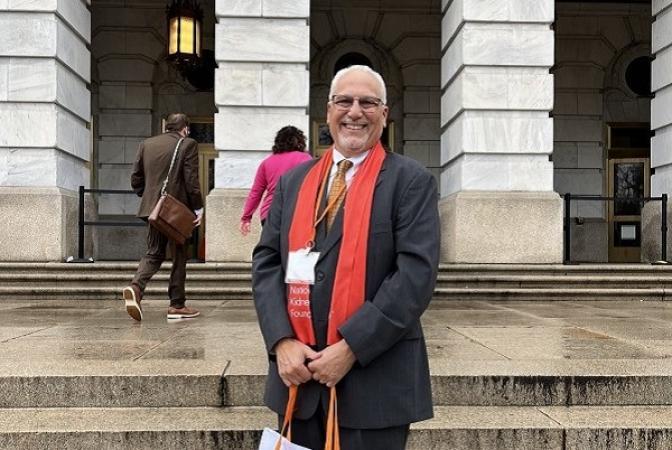

Oklahoma-based advocate Gene Blankenship didn't let dialysis keep him from fostering productive relationships with his lawmakers.

The Living Donor Protection Act prevents insurance companies from denying, limiting, or charging higher premiums for coverage solely based on someone’s status as a living donor. A Johns Hopkins study found that 1 in 4 living donors experienced this kind of discrimination when trying to obtain or change coverage. Living donors should never encounter discrimination after their selfless act of donating an organ. Their courageous and generous act of organ donation should be met with appreciation and support, not higher premiums and challenges obtaining coverage.

Paid leave for living organ donors helps an employer provide compensated time off for individuals who donate an organ. This type of policy is aimed at supporting and encouraging organ donation to save lives and improve the health of those in need of an organ transplant. States create their own policies that determine the length of time and compensation for an employee considering living donation. There is also variation in policies between state entities and private employers.

Employer tax incentives offer a compelling way to motivate employers to provide paid time off for employees engaging in organ donation. By implementing such incentives, employers are encouraged to support and facilitate this altruistic act, contributing to the well-being of their employees and fostering a culture of organ donation awareness and support in the workplace.

As CKD rates increase, it is imperative that states establish a CKD Task Force to address the importance of early detection, diagnosis, and timely treatment of kidney disease. These task forces coordinate the implementation of a statewide plan for prevention, early screening, diagnosis, and management of chronic kidney disease, as well as education of the public and healthcare professionals. A broad, diverse group of public and private stakeholders foster a stronger approach in addressing key issues facing the kidney community.

As more states pass the Living Donor Protection Act, which protects living donors from insurance discrimination, the situation of kidney patients in North Carolina is becoming more dire.

When the Nevada state legislature unanimously passed Living Donor Protection Act (LDPA) legislation in early May, Nevada-based advocate June Monroe had multiple reasons to celebrate.

After living with unmedicated bipolar disorder, Shannon Glynn was thrilled when a doctor prescribed medication to improve her quality of life. But there was a catch.